estate tax changes in 2025

Its 1158 million for deaths occurring in 2020 up from 114. The tax reform law doubled the BEA for tax-years 2018 through 2025.

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Fast Reliable Answers.

. Ad Settling a loved ones estate can be time consuming. Ad Offers Comprehensive Explanations Of Topics Often Researched By Tax Professionals. We dont make judgments or prescribe specific policies.

Empowering executors to think clearly. At a tax rate of 40 thats a 72 million tax bill. This means that after December 31 2025 your ability to pass on wealth during your life or at death will be dramatically reduced when the current estate tax provision.

Because the BEA is adjusted annually for inflation the 2018. Governor Kathy Hochul today announced that New York State has been selected by Inland Waterways International as the host of the 2025 World Canals Conference an event. The exemption was 55 million before the law change.

2010 and before January 1 2025 the credit equals 100 of the federal credit amount allowed for the same. Metropolitan commuter transportation mobility tax. The TCJA temporarily increased the BEA from 5.

This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. Given a current federal estate tax rate of 40 the overall effect of an increase is. The credit is first used during life to offset gift tax and any remaining credit is available to reduce or eliminate estate tax.

The Tax Cuts and Jobs Act of 2017 increased the federal gift and estate tax basic exclusion amount BEA to 1158 million per individual or 2316 million per couple adjusted. If they do nothing and live past 2025 they may have a taxable estate of 18 million 30 million less 12 million exemptions. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Estate Tax Exclusion Change Now and in 2025 Uncategorized Sharon Ravenscroft Wednesday 26 January 2022 399 Hits The estate tax exclusion has increased to 1206. See what makes us different. Were here to make it easier.

The federal estate tax exemption is indexed for inflation so it increases periodically usually yearly. It cut the number of individuals who would be subject to the 40 estate tax by about two-thirds. Estate Tax Exclusion Changes Now and in 2025 Jan 28 2022 - News Press Releases Sharon D.

Were here to make it easier. Ad Settling a loved ones estate can be time consuming. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

The current estate and gift tax exemption is scheduled to end on the last day of 2025. Find out whats ahead with your custom roadmap. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

For an estate which is paying federal estate tax there is a deduction for state estate tax. Empowering executors to think clearly. How did the tax reform law change gift and estate taxes.

Fisher Investments has 40 years of helping thousands of investors and their families. Ravenscroft The estate tax exclusion has increased to 1206 million. It could potentially be signed in a different form where the proposed revisions are brought back in.

Leading Federal Tax Law Reference Guides. Second the federal estate tax exemption amount is still dropping on January. After that the exemption amount will drop back down to the prior laws 5 million cap.

Find out whats ahead with your custom roadmap.

Financial Planning Now In Anticipation Of The Upcoming Election Aaa Cpa

Democrats Might Not Touch These Taxes But They Re Going Up Anyway

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

How The Tcja Tax Law Affects Your Personal Finances

2020 Estate Planning Update Helsell Fetterman

The Tax Cuts And Jobs Act Key Changes And Their Impact Bny Mellon Wealth Management

How Could We Reform The Estate Tax Tax Policy Center

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

How Could We Reform The Estate Tax Tax Policy Center

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How The Tcja Tax Law Affects Your Personal Finances

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How The Tcja Tax Law Affects Your Personal Finances

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Start Planning Now For A Higher Tax Environment Pay Taxes Later

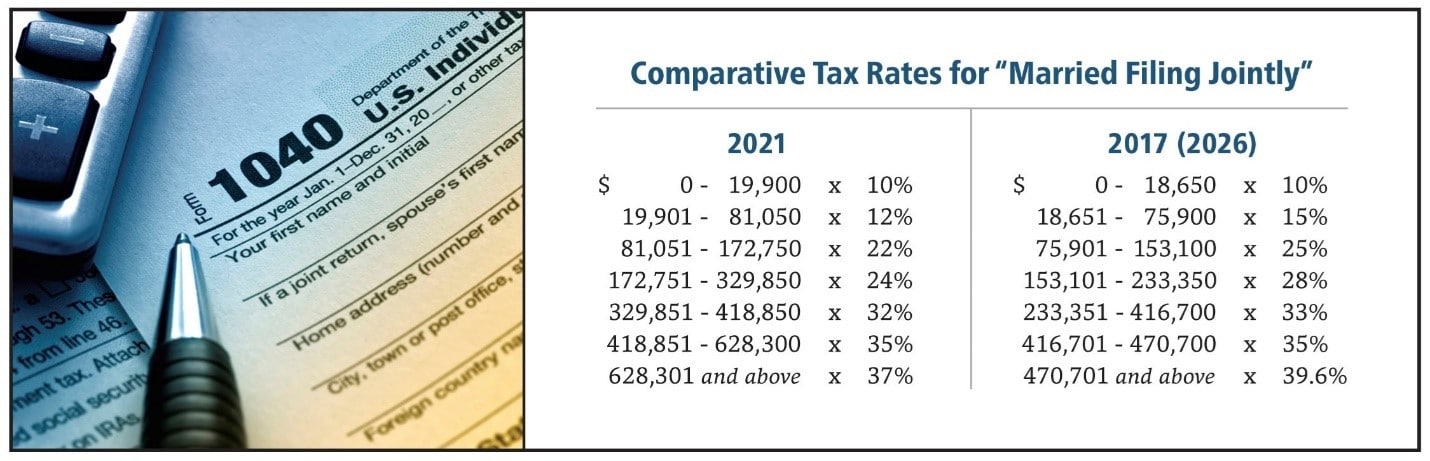

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)